Get the free sbi demand draft cancellation charges 2025

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

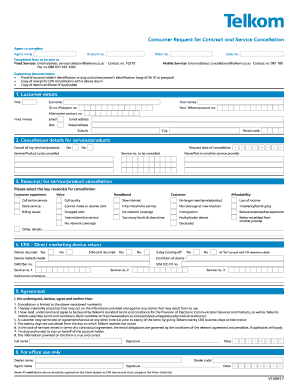

Understanding the Cancellation Letter Form

What is the Cancellation Letter Form?

The DD cancellation letter form is a formal document used to initiate the cancellation of a direct deposit arrangement. It serves as a written request for the discontinuation of funds being directly deposited into an account. Typically, this form is utilized by clients who wish to stop payments from an employer or another source.

When to Use the Cancellation Letter Form

This form should be used when a client wishes to cancel an existing direct deposit arrangement. Situations that may prompt its use include changing banks, discontinuing services with an employer, or altering payment methods. It is essential to submit the letter ahead of the next scheduled deposit to ensure the cancellation is processed in time.

Who Needs the Cancellation Letter Form?

Individuals who are receiving direct deposits from their employers or other entities may need this form. Clients need to ensure that they formally request a cancellation to avoid any errors in their financial management. Additionally, businesses may use it to manage employee payment preferences effectively.

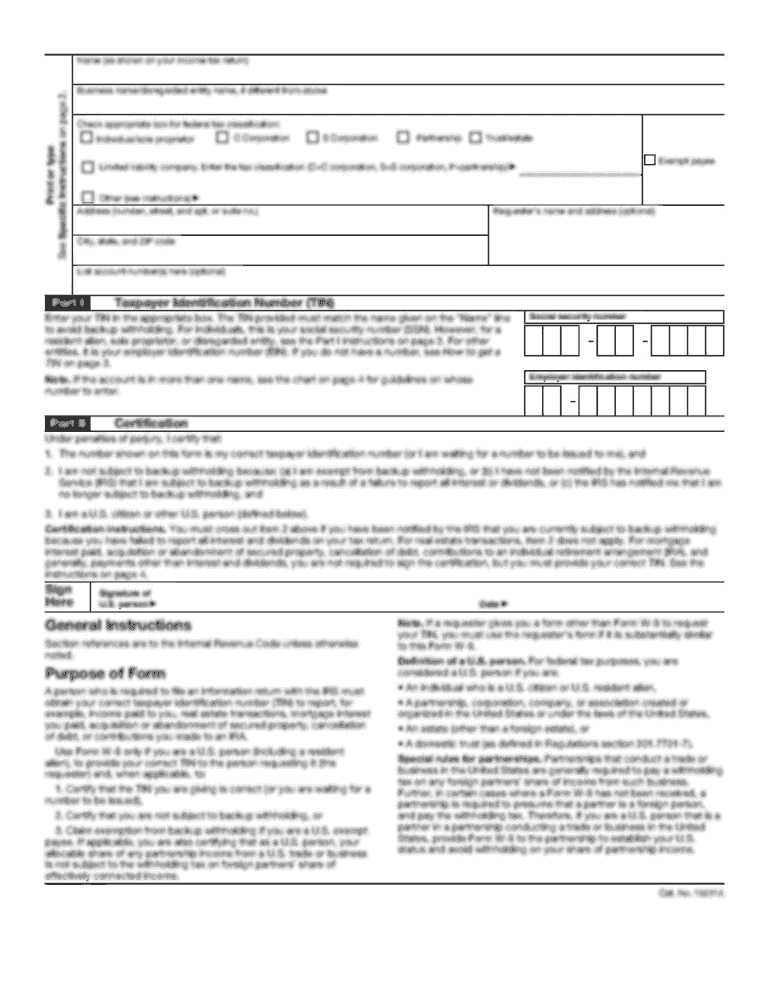

Required Documents and Information

When filling out the DD cancellation letter form, it is important to include specific information to facilitate the cancellation process. Required details typically include the client’s name, the name of the financial institution, the account number, and a clear indication of the request to cancel future deposits.

How to Fill the Cancellation Letter Form

Filling out the DD cancellation letter form involves several key steps. Begin by writing the date and the name of the entity managing the direct deposit. Follow this with your personal information, including your account details. Clearly state your request to cancel the direct deposit, and ensure to include any additional information that may be required, such as your contact details.

Best Practices for Accurate Completion

To ensure the accurate completion of the DD cancellation letter form, it is advisable to double-check all filled details. Make sure your account number is correct, and review the information provided for any possible errors. Sending the letter well in advance of any planned cancellation can help prevent complications with your next direct deposit.

Common Errors and Troubleshooting

Common mistakes when completing the DD cancellation letter form can include providing an incorrect account number or failing to include essential information. If a submission is rejected or a cancellation is not processed, it is important to follow up with the relevant institution to ascertain the issue. Keeping a copy of the cancellation letter can also help in case of disputes.

Frequently Asked Questions about sbi demand draft cancellation procedure issuing branch refund charges form

What should I do if my cancellation request is denied?

If your cancellation request is denied, contact the institution managing your direct deposits directly for clarification. It is important to understand the reasons behind the denial and to provide any additional information they may require.

How long does it take for a cancellation to process?

Processing times for a cancellation can vary. Typically, clients should allow a few business days for the cancellation to be finalized, but it is best to submit the request well in advance of the next scheduled deposit.

pdfFiller scores top ratings on review platforms